Hello Dear Learners if you are looking for Notes on Disputes Management in SAP S4 Hana FSCM | Disputes Management in SAP FSCM | Disputes Management in SAP FSCM S4 Hana | SAP S4 Hana FSCM Disputes Management Tutorial then you will get Idea in this blog.

Before We going to start with Dispute management let us know about other important terms –

What is SAP FSCM?

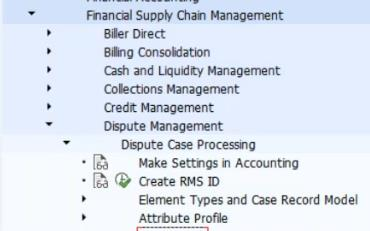

SAP Financial Supply Chain Management optimizes the financial and information flows within a company and between business partners. Following components of SAP Financial Supply Chain

Management are implemented at OLAM:

- SAP Collections Management: Application for proactive receivables management

- SAP Dispute Management: Application for efficient processing of receivables-related dispute cases

SAP Collections Management

The components of SAP Collections Management support you in active receivables management. Using collections strategies, you can valuate and prioritize customers from a receivables management view. Customers that fulfill the rules defined in a strategy are distributed to the worklists of the collection specialists. The collection specialists then contact the customers

in their order of priority in order to collect receivables.

You can display an overview of the current status of the open invoices of a customer account as well as the last payments, the customer contacts, and open resubmissions. If a customer gives a promise to pay, you can enter this in the system and follow its status. You can also define that a

customer is to reappear on the worklist on a certain date. When you return to the worklist, you can document the complete customer contact in the system.

Roles in Collections Management

The functionalities in this module is designed for the following roles:

- Collections Specialist (Responsible for Collecting receivables)

- Collections Supervisor/Manager (Responsible for controlling the process of collecting receivables)

Collections Specialist in SAP FSCM

The collection specialist performs this process. It covers the following

process steps:

- Call Up Worklist

- Prepare Customer Contact

- Contact Customer

Call up Work list:

Transaction code for calling up the worklist is UDM_SPECIALIST used.

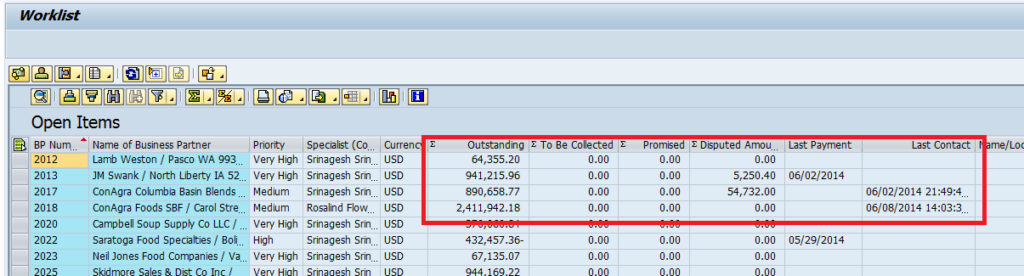

A worklist is created automatically for each collection specialist on a daily basis . The collection specialist logs on to the Collections Management system and calls up the worklist. The worklist contains all customers to be contacted in order of priority. The prioritization of the customers in the worklist (worklist items) is determined by the collection strategy assigned to the customer.

Prepare customer contact:

To prepare the customer contact, the collection specialist needs information about why the contact is necessary.He also needs to consider the customer’s account and previous customer contacts.

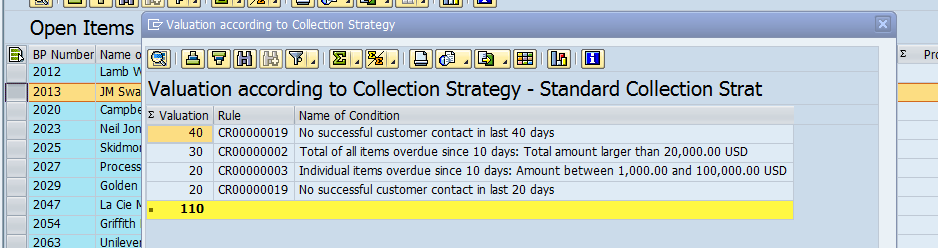

He can see why the customer contact is necessary by displaying the valuation of the customer according to the collection strategy. Here he can see an overview of all collection rules fulfilled by the customer.

Example:

There was no successful customer contact in the last 40 days.

For a view of the current status of the customer account, the collection specialist can look at the work list. This contains key figures for the customer, such as outstanding amounts, the amount to be collected, the amount of broken promises to pay, or when and with whom the last customer contact was carried out.

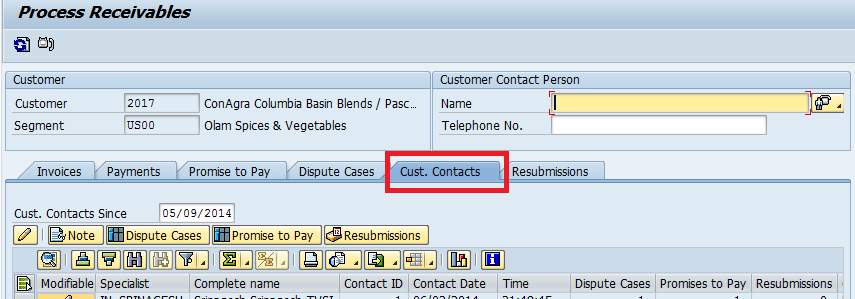

By navigating to the function Process Receivables ( ), the collection specialist can display the detail view of the customer. Here the open receivables of the customer are listed with their respective status. At a glance the collection specialist can see which part of the invoice is open, whether anything has already been paid or credited and how much, and promises to pay, dispute cases, and dunning notices for the invoice. The collection specialist can also view an overview of previous customer contacts that informs him of the results of previous contacts with specific contact persons at the customer. He can also see promises to pay, dispute cases, and resubmissions that arose from customer contacts.

Contact Customer

To make the contact, the collection specialist uses the contact data of the contact person at the customer that is displayed in the function Process Receivables. The collection specialist enters the results of the customer contact in the system.

If a customer promises to pay open invoices, the collection specialist creates promises to pay for the invoices specified. The system automatically monitors whether this promise to pay is kept. If the collection strategy is configured accordingly, when promises to pay are broken the customer appears on the worklist again.

If the customer objects to an invoice, the collection specialist can create a dispute case for the invoice. The department responsible can process the dispute case immediately. If the result of the dispute case processing is such that the objections of the customer are unjustified, the corresponding status of the dispute case leads to the customer appearing on the worklist

again. The invoice is relevant for receivables management again.

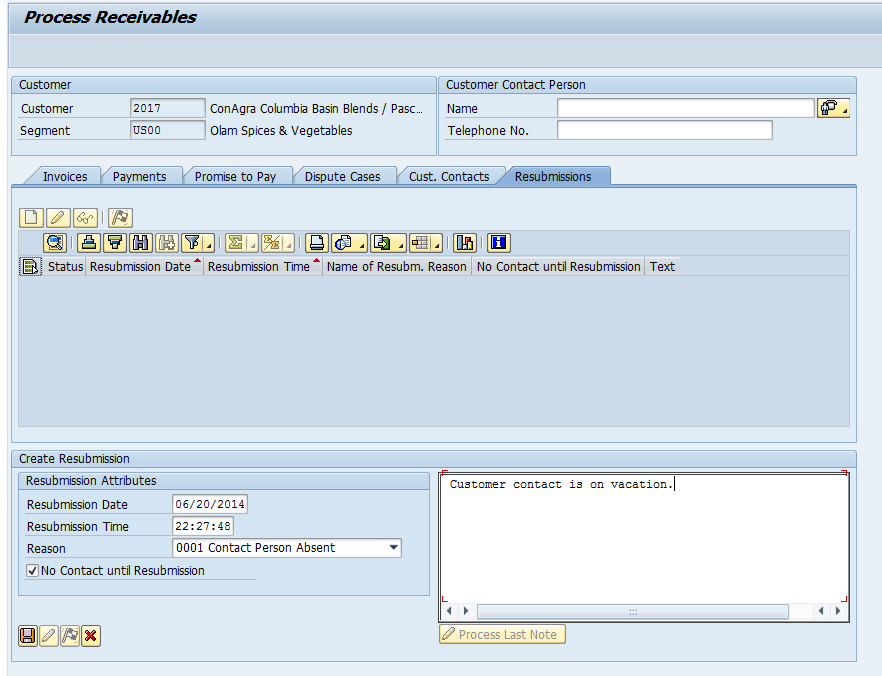

If the collection specialist cannot reach the contact person, or the contact person requests that the collection specialist calls back, the specialist can create a resubmission. On the date specified the customer appears on the worklist again.

After the customer contact has been carried out, the contact is summarized and documented. The system creates a standard note and adds all promises to pay, dispute cases, and resubmissions created to the customer contact.

The collection specialist then enters a Contact Result and returns to the worklist. There he prepares the next customer contact.

If the Collection specialist chooses a Contact Result which indicates that the customer was successfully contacted, the Business partner is automatically disappears from the worklist & is transferred to the Completed items list. These Business partners can be accessed by clicking

on the Display completed items icon. ( )

Collections Supervisor

The collection manager performs this process. He is responsible for ensuring that the receivables are collected according to the financial targets of the company. The process covers the following process steps:

- Define Collection Strategies

- Process Collection Groups

- Edit Business partner master record

- Change Assignment of Collection Group and Collection Specialist to Customer

- Monitor Collection of Receivables

The transaction code for accessing the work list for a Collections Supervisor/Manager is UDM_SUPERVISOR.

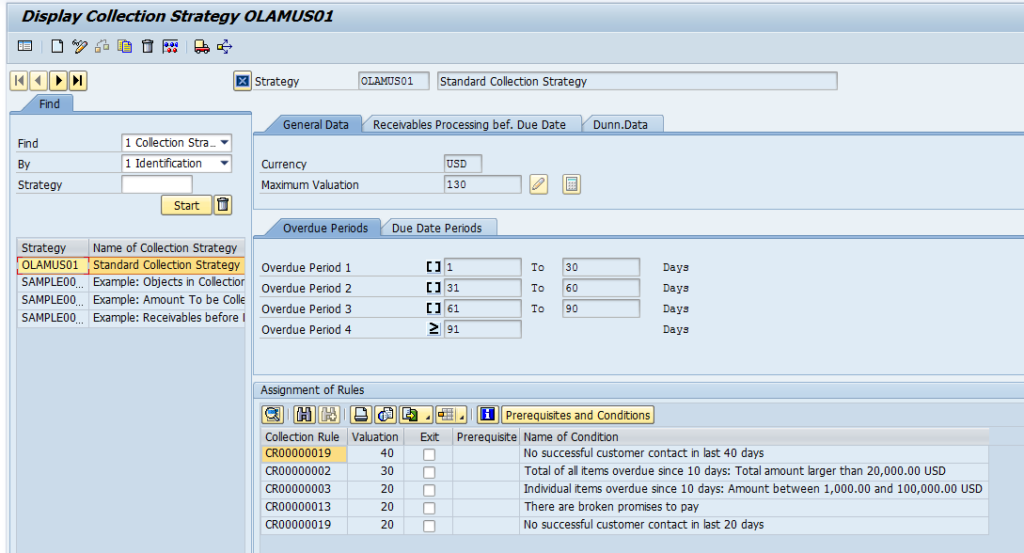

Define Collection Strategies

The collection manager defines the criteria (collection rules) to be used for analyzing customers and prioritizing them for receivables management. To do this he defines collection strategies and enters them in the system. He can create different strategies depending on the customer group,

region, or company situation. In a collection strategy, all collection rules that are relevant for collecting receivables are listed and prioritized.

All customers are analyzed and valuated according to the strategy assigned to them and, dependent on the valuation, included in the worklist. The more rules that apply to a customer, the higher this customer is prioritized in the worklist. Collection strategies are therefore the basis for the automatic creation of worklists.

Note: The transaction code for creating or editing Collection Strategy is UDM_STRATEGY.

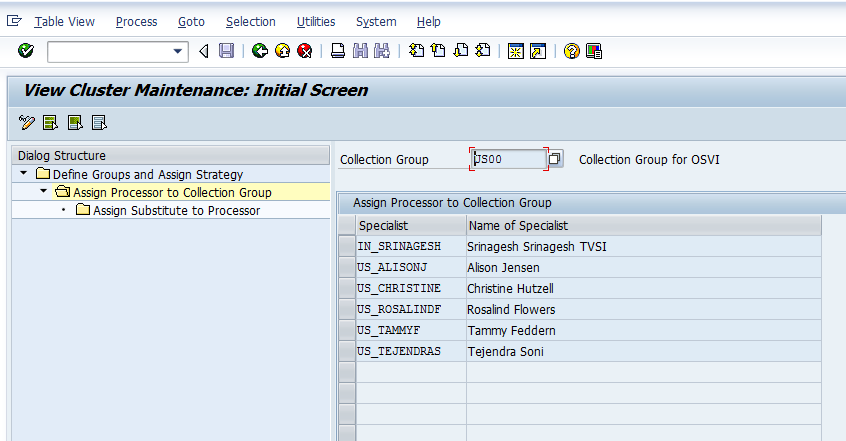

Process Collection groups

Collection groups cover all collection specialists that collect receivables using the same collection strategy. The collection manager is responsible for assigning his employees to collection groups. He can also define a substitute for each collection specialist in a collection group for times

when the specialist is absent. The work list items for the absent colleague are then assigned to this substitute automatically.

The collection manager also determines the collection strategy that a collection group uses to collect receivables.

The transaction code for Collection groups in UDM_GROUP.

Edit Business Partner Master Record

In SAP Collections Management, every customer has a business partner master record. In this master record, the collection group and (optional) collection specialist responsible for the customer are defined. The collection strategy relevant for valuating the customer is derived from the collection group. The collection groups and collection specialists are assigned automatically (see the process Data Synchronization and Creation of Worklists).

If necessary, the collection manager can assign a different collection specialist to the customer. This may be necessary, for example, to improve the distribution of the workload in his team and to react to changes in personnel. He can also assign a different collection group to the customer

temporarily and, if required, an alternative collection specialist.

The transaction code for editing a Business partner master record is UDM_BP.

Monitor Collection of Receivables

The collection manager is responsible for the successful collection of receivables. To monitor this process, he can display the worklist items for all collection groups assigned to him. He can display statistics that help him to evaluate how many worklist items have been completed, how many are still open, and how many successful or unsuccessful customer contacts have already been carried

out.

He can also redistribute worklist items between collection specialists for a more even distribution of the workload and to ensure that high priority items are processed quickly.

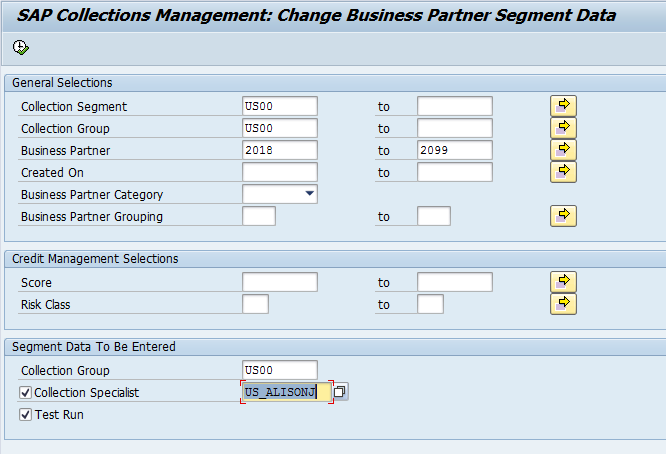

Change Assignment of Collection Group and Collection Specialist to Customer

The collection supervisor can reassign Business partners from one group to other and he can also reassign the specialists for a group of business partners as well.

The transaction code for the above function is UDM_BP_GRP.

Process Receivables

After opening a business partner, the user will be presented with this screen. The specialist can perform various functions in this screen which were briefly discussed in the above sections. Detailed explanation of each of these tabs is presented here:

- Invoices

- Payments

- Promises to Pay

- Dispute Cases

- Customer Contacts

- Resubmissions

Invoices

This function provides you with an overview of all open invoices for a customer in the company codes of the current collection segment. You can display additional information for each invoice, and create promises to pay and dispute cases. The tab page Invoices is part of the function Process Receivables.

You can see all open invoices for the selected customer and those where there are open residual items. The amountPromised (Residual) results from the amount promised minus the amount paid for the promise to pay. The amount paid for the promise to pay results from the Process

Integration with Accounts Receivable.

List of Open Credit Items

If the account contains open credit items with no invoice reference, these are totaled by currency, displayed in rows highlighted with different colors, and have the entry Credit in the column Document Number. Double-click on these rows to display a list of items that have been totaled

on the lower part of the screen

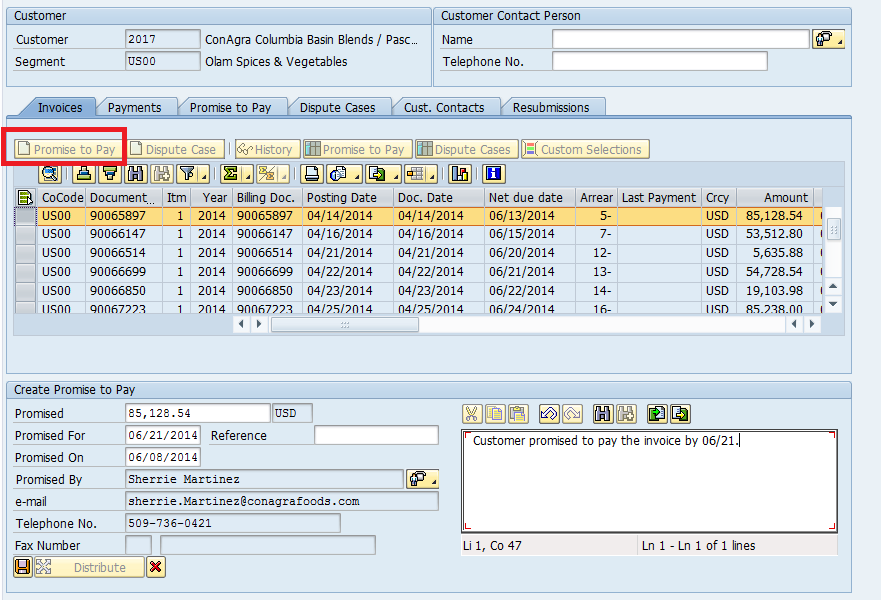

Creating Promises to Pay

Select one or more invoices for which you want to create a promise to pay and choose Promise to pay with the quick info text Create Promise to Pay.

The screen area Create Promise to Pay appears under the list of invoices. In the field Promised, the total of the open items is proposed automatically.

If you select invoices that already have a promise to pay with the system status Open, this is confirmed and the new promise to pay contains a level increased by one.

If you enter a promise to pay for several invoices, the system automatically creates individual promises to pay for each invoice when you save so that you can process and follow promises to pay at invoice level.

- Enter the data required for the promise to pay.

In the field Reference, you can enter data such as a check number that

the customer gave you. You can also enter notes in a text field. - If you have only selected one invoice, or if the amount promised for

several invoices agrees with the total open amount, you can save the

promise(s) to pay. Otherwise, you have to specify how the amount

promised is distributed between the invoices selected.

a. Choose with the quick info text Distribution.

The screen area Distribute Amount appears.

b. Assign the amount that was promised to each invoice in the list of

invoices for which a promise was submitted. The following

automatic distribution functions are available for this distribution:

- § Equally: Each invoice receives a part of the total amount

promised, depending on the open amount. - § According to due date: The invoice with the earliest due date

receives a part of the amount promised first. If the total

promised amount was not assigned, the invoice with the next

due date receives a part and so on.

If you distribute the amount manually, choose with the quick

info text Check Distribution to ensure that the total amount

distributed matches the total amount promised. If this is not the

case, but you want to retain the amounts you distributed, the

system automatically changes the total amount promised to the

new total of the amounts you entered.

3. Save your entries.

Payments

This function provides you with an overview of the payments of a customer. The tab page Payments is part of the function Process Receivables.

For the customer selected, you see the incoming payments of the last 30

days that have been posted in the company codes of the current collection

segment. You can change this period if necessary.

For an exact where used list for the payment, choose History. Based on

the incoming payment, all invoices paid or partially paid by this payment

are listed in a tree structure. The detailed information for each respective

invoice is structured as described under Invoices, whereby the payment

selected is highlighted with a color.

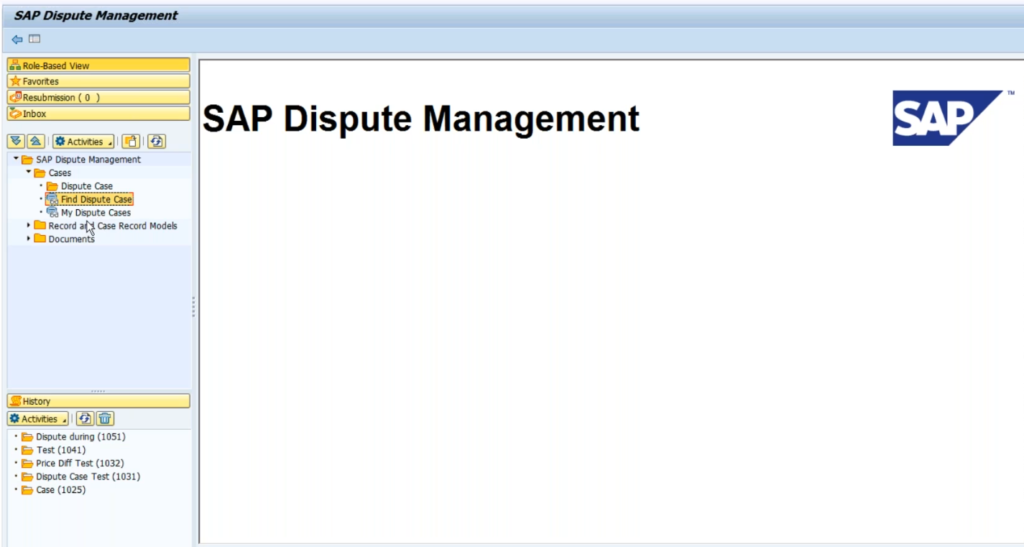

Dispute Cases

This function provides you with an overview of all dispute cases of the customer that contain at least one item asDisputed Object. The tab page Dispute Cases is part of the function Process Receivables.

If you select a dispute case from the list and choose Dispute Case with the quick info text Display Dispute Case, the system displays the dispute case with all header data, notes, log, and the case record with the linked objects.

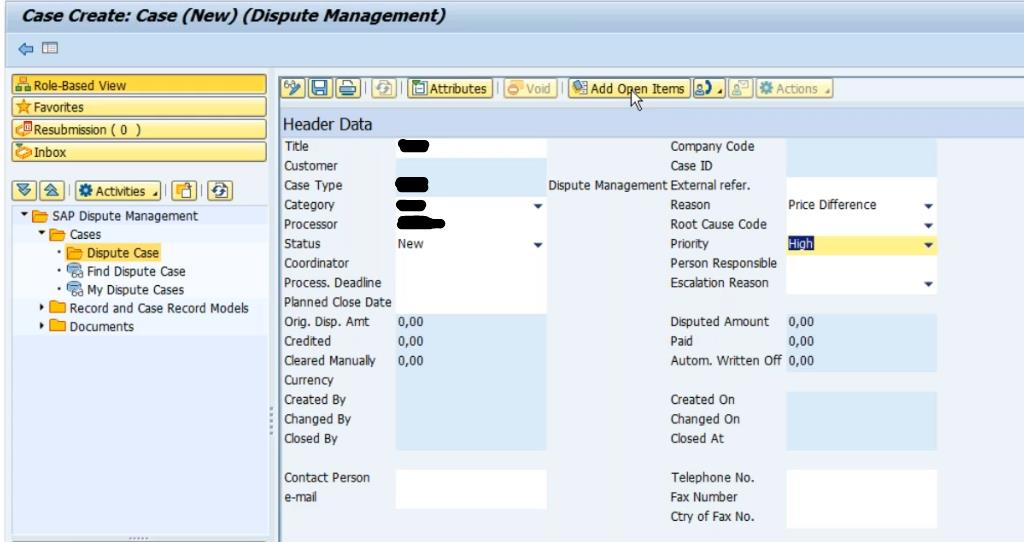

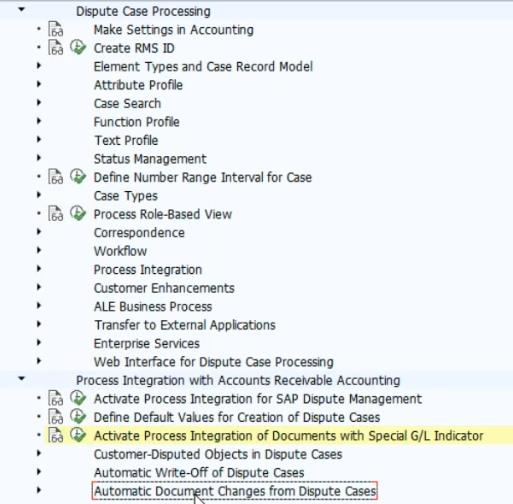

Disputes case is created if there is a difference between received amount and invoice amount from customer.There are three options for the creation of dispute creation:

1.Creating dispute from complaint

2.Creating dispute from underpayment with reason

3.Schedule automatic dispute creation job (Using residual item)

When dispute case is created if it is justified then it will be write off on

the other hand if it is not justified then we start receivable collection.

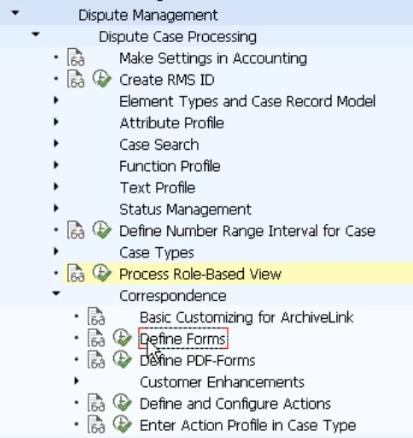

Case types are defined to segregate different disputes categories.

We have to define default values for the creation of dispute case and

we have to specify the case type for our company code.

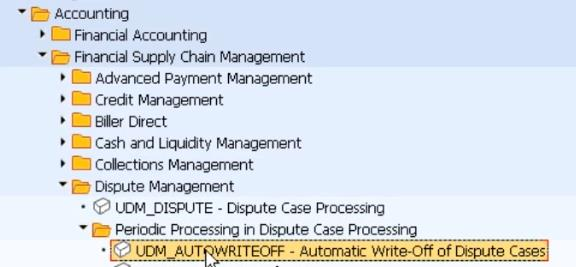

Dispute case is created using tcode: UDM_DISPUTE

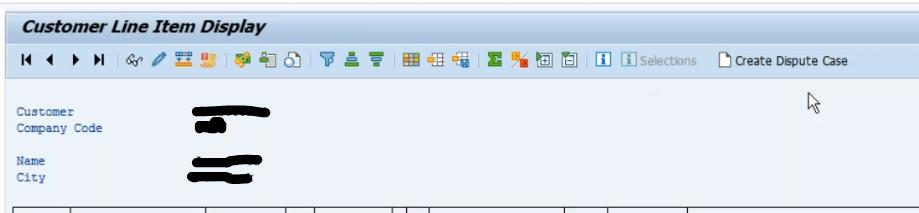

After creation of dispute case it is assigned to the open item.

To Include any specific field in the dispute case we have to define it in the attribute profile.

When we assign the open item to the dispute case, it will automatically pick the amount, currency, credit terms, customer of that line item. Dispute case is automatically assigned to the customer line item.

During posting of incoming payment if customer complain about the amount and pays less amount, dispute case can be created for the residual amount along with the incoming amount posting.

When the dispute is been resolved status of that open item dispute case will have to change according to result obtained.

If we want to allow the system to create dispute cases for special GL transaction then we have to initially define it before

Correspondence will be created if we want to notify the customer about the status of their complain.

If dispute case is not resolved then we execute write off program to post the expense for the remaining payment.